Non-US clients can trade options for $5 per trade + $0.65 contract. TradeStation options fees are low for trading stock index options.

TradeStation commission of a $10,000 government bond trade TradeStation has generally low bond fees.

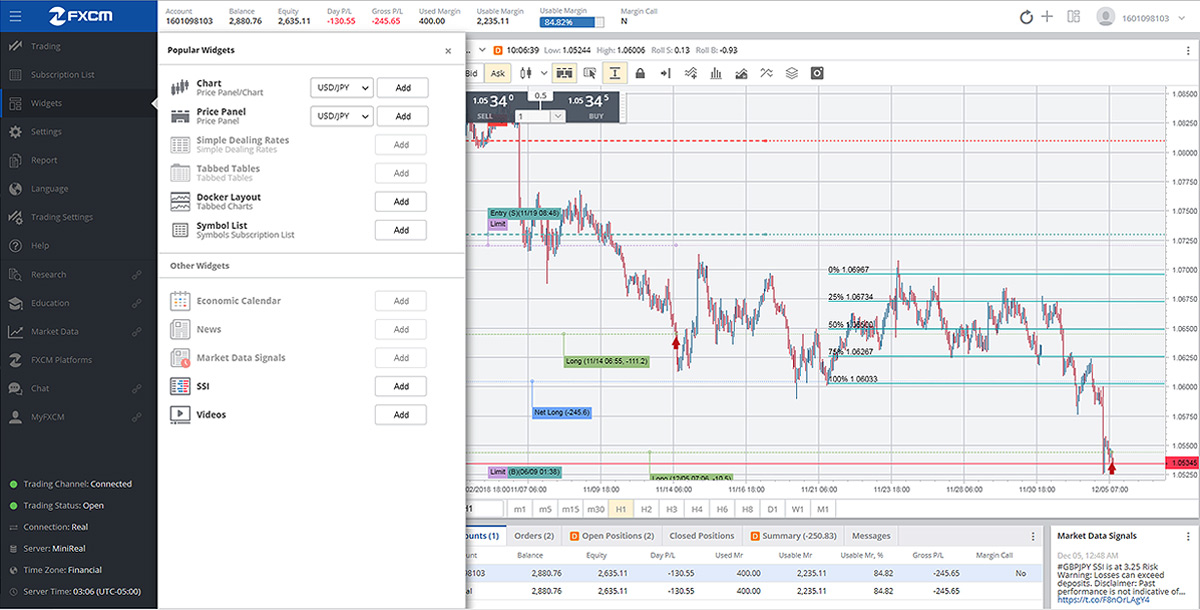

TradeStation commission for a $2,000 fund purchase However, you'll have to pay interest on this borrowed money – this is called the margin rate, and It can account for a significant portion of your overall trading costs. Trading on margin basically means that you borrow money from your broker and can purchase more shares than you could with just the available cash in your account. If you plan to trade stocks on margin, you should check TradeStation's margin rates. The current version of the calculator only handles whole share transactions, it does not calculate with fractional share trades. TradeStation stock and ETF commission of a $2,000 trade Non-US clients can trade stocks and ETFs for $5 per trade. TradeStation offers stock and ETF trading, charging zero commission.Ĭommission-free trading of equities and ETFs is available if you are a US resident and apply for the TS GO or TS Select plan. See a more detailed comparison of TradeStation alternatives. These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. We compared the fees at TradeStation with two similar brokers we selected, tastytrade and Interactive Brokers. $50 per year if your balance is less than $2,000 or if you make less than 5 trades per year TradeStation offer a full range of professional trading instruments: forex, futures, options, and stocks.Commission-free up to the first 10,000 shares per trade for US clients.

0 kommentar(er)

0 kommentar(er)